This scheme is a good option for parents to use NPS Vatsalya scheme to set up a good amount of savings for the better future of their children by opening a pension account for their child and investing the money in this account for a long time and taking advantage of the power of compound interest on this money.

NPS Vatsalya Yojana offers flexible contributions and good investment options. In this account, parents can contribute an amount of Rs 1,000 in the child’s name in a year, making this scheme affordable for families with all financial backgrounds.

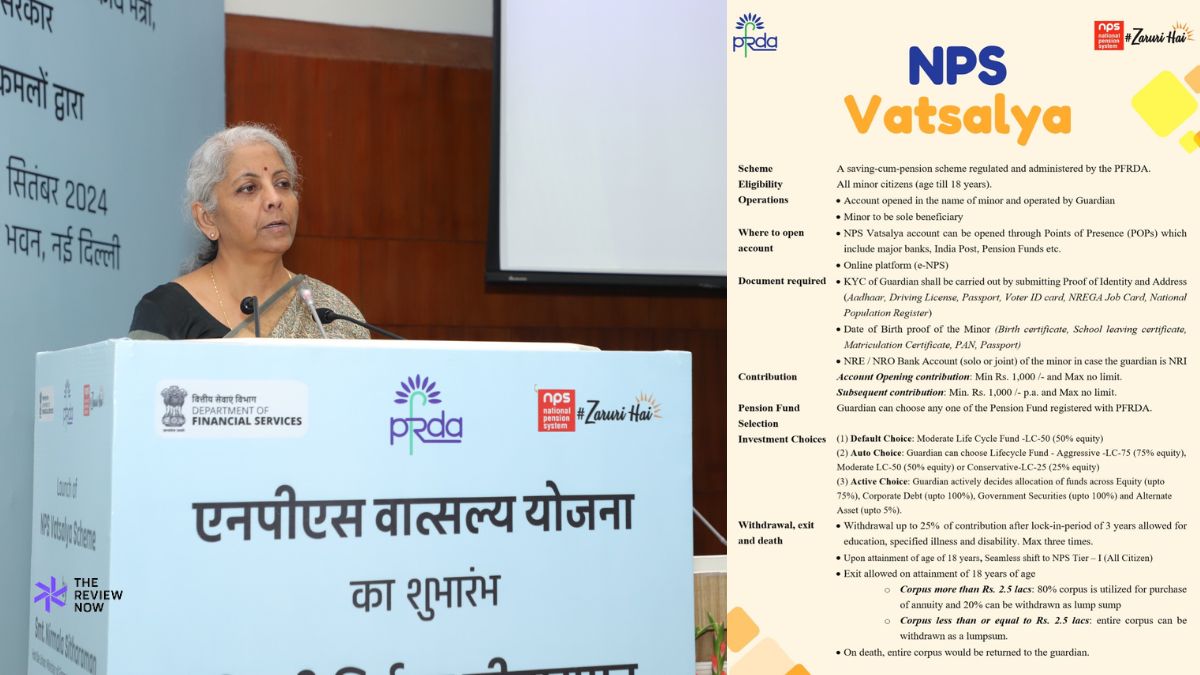

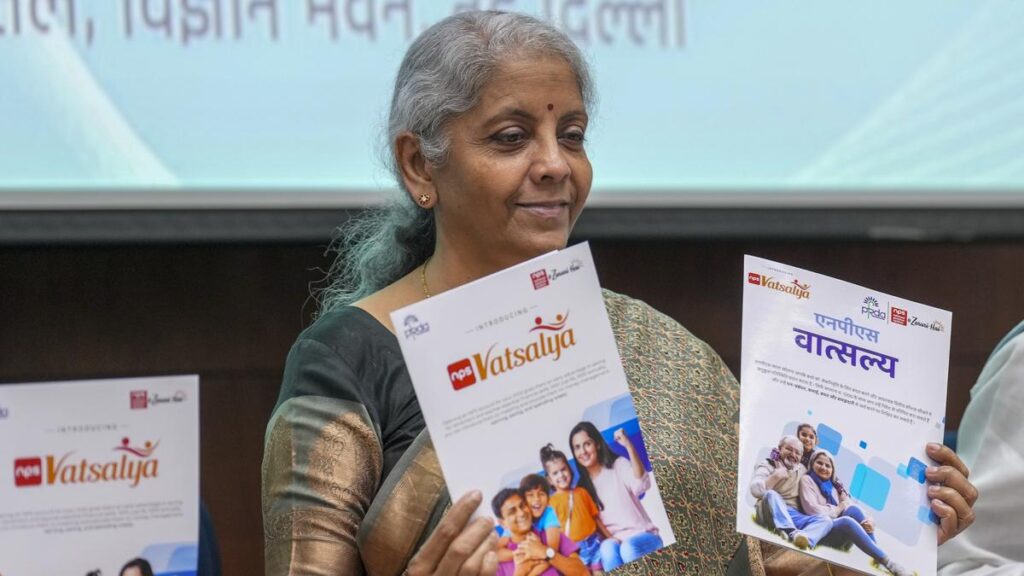

As announced in the Union Budget 2024 in July 2024, Finance Minister Nirmala Sitharaman inaugurated NPS Vatsalya, a pension scheme for all minors. The initiative was launched at only 75 locations across the country, which were allotted to young customers with more than 250 PRAN i.e. Permanent Retirement Account Numbers.

What Is Nps Vatsalya Scheme?

NPS Vatsalya Yojana is a contributory pension scheme regulated and run by the Pension Fund Regulatory and Development Authority (PFRDA). This scheme is mainly designed for all Indian minor citizens up to the age of 18 years.

The fastest way to open an account under this scheme is eNPS. With this system, you get an effortless facility to open an NPS Vatsalya account and invest in this account. NPS Vatsalya Yojana has been started by the Ministry of Women and Child Development.

This scheme is a scheme sponsored by the Central Government. The main objective of this scheme is to provide complete care and protection to children in difficult circumstances. Along with this, this scheme ensures opportunities for children to reach their full potential and develop in all aspects.

Every parent wants their child’s future to be secure, whether it is financially, emotionally or socially, it should be good. But the financial part plays a very important role in this. Also, no one knows what is going to happen in the future. That is why all parents work hard for the better future of their children. Their hard work can bring even better results by investing in this scheme.

How To Open An Account On The Online Platform Under NPS Vatsalya Scheme

To open an NPS account online, we will tell you some important steps with the help of which you can open your child’s account: –

Step 1: First of all, go to the official website of the eNPS portal, which will host the NPS Vatsalya Yojana.

Step 2: On the website, choose the option to apply for the NPS Vatsalya Yojana, which is primarily designed for minors.

Step 3: After this, complete the registration by filling the minor’s information and the guardian’s KYC details.

Step 4: Now upload the necessary documents like the guardian’s identity card, address proof as well as the minor’s age certificate.

Step 5: After registering, contribute a minimum amount of Rs 1000 to the account.

Step 5: After registering, contribute a minimum amount of Rs 1000 to the account. Step 6 :- After successful registration and contribution, a Permanent Pension Account Number (PRAN) card will be issued to the minor subscriber.

Apart from this, you can also open this account through banks and Points of Presence (POP) including India Post.

Read more: Upsc Personal Assistant 2024 Daf Online Form