How Indian Celebrities Are Investing in Startups and Building Long-Term Wealth 2026

Indian celebrities are no longer solely reliant on blockbuster films, packed stadiums, or brand endorsements for their wealth. Behind the glitz and glamour, a quiet transformation is underway, with Indian actors, cricketers, and digital stars becoming active investors. From supporting early-stage startups to acquiring equity stakes in established companies, Indian celebrities are not just promoters but are carving out a significant role in India’s entrepreneurial ecosystem.

This shift reflects how fame, fortune, and influence operate in today’s India. As the startup industry reshapes the economy and creates multi-billion dollar opportunities, celebrities are focusing on long-term wealth creation rather than short-term endorsements. Many are diversifying their income streams by aligning their personal brands with innovative businesses, while also helping startups gain credibility, visibility, and trust in a highly competitive market.

As the Indian startup ecosystem matures, Indian celebrities are making increasingly savvy investments.

How Indian Celebrities Are Investing in Startups

Today, Indian celebrities are moving beyond simply signing checks or lending their faces to marketing campaigns and are becoming more actively involved in startup investments. Many are becoming part of the ecosystem as early-stage investors, supporting startups in their idea or growth phases, where both the risks and rewards are high. Instead of traditional financial instruments, they are opting for equity stakes that allow them to grow alongside the business.

In many cases, these investments are also aligned with a celebrity’s personal interests or public image. Stars focused on fitness are investing in wellness and health-tech startups, while actors known for their digital presence often support tech-driven or consumer-facing brands.

What makes this trend particularly noteworthy is the shift from passive involvement to active participation. Celebrities are now attending board meetings, organically promoting the products on social media, and leveraging their networks for partnerships and funding. By combining financial support with influence and credibility, Indian celebrities are redefining what it means to be an investor in the startup world.

Why Startups Have Become the New Investment Choice for Celebrities

For Indian celebrities, startups offer something that traditional investments often don’t: direct involvement in innovation and the potential for rapid growth. With film careers, sports contracts, and endorsement deals having a limited lifespan, startups provide an opportunity to build wealth that lasts beyond their active years in the spotlight. This long-term perspective is a major reason why celebrities are showing increasing interest in entrepreneurial ventures.

Another crucial factor in this trend is diversification. Relying solely on entertainment income can be precarious, but startup investments allow celebrities to spread their financial risk across multiple sectors. As India’s startup ecosystem matures, these ventures are no longer viewed as risky experiments but rather as structured businesses with strong growth potential and global ambitions.

There’s also an aspect of relevance and personal branding involved. By investing in modern, consumer-focused startups, Indian celebrities stay connected with younger audiences and evolving Indian market trends. Supporting innovative ideas, sustainable products, or tech-driven platforms helps them remain influential in the rapidly changing digital economy, while also associating themselves with businesses that reflect their values and vision.

The Shift From Brand Endorsements to Equity Ownership

For years, brand endorsements were the primary way for Indian celebrities to monetize their popularity outside of films or sports. These deals offered quick returns, but they also ended once the campaign was over. Today, many bollywood celebrities are rethinking this model and opting for equity ownership instead, where their involvement can generate value over the long term rather than just a one-time payment.

Equity-based partnerships allow celebrities to become more deeply involved with the brands they support. Instead of simply receiving a one-time payment, they receive a stake in the company, directly linking their success to the startup’s performance. This approach fosters a deeper commitment, as celebrities become emotionally and financially invested not only in the business’s advertising reach but in its entire journey.

This shift and investment also benefits startups. When a celebrity is a co-owner rather than just a paid endorser, their support feels more authentic to consumers. When audiences believe the celebrity genuinely trusts the product, they are more likely to trust it themselves. Consequently, equity ownership has become a win-win arrangement that provides startups with credibility and offers celebrities a smart, more sustainable way to increase their wealth.

Startup Sectors Attracting Indian Celebrity Investors

Indian celebrities prefer investing in startup sectors that naturally align with their public image and daily lives. Therefore, consumer-facing businesses are among the most popular options for celebrities, especially direct-to-consumer brands in food, fashion, beauty, and wellness. These startups benefit greatly from the association with a celebrity, while the investors gain from promoting products they are personally connected to.

The fitness and health-tech sectors have also emerged as major areas of interest. With increasing awareness about healthy lifestyles, many celebrities are supporting gyms, fitness apps, nutrition brands, and mental wellness platforms. Their involvement instantly boosts credibility.

Technology-driven startups are another strong focus area for celebrities. Fintech, edtech, and gaming platforms have attracted celebrity investors who recognize India’s rapidly growing digital user base. These sectors offer scalability and long-term growth potential, making them ideal for celebrities looking to invest in businesses that can become major market leaders over time.

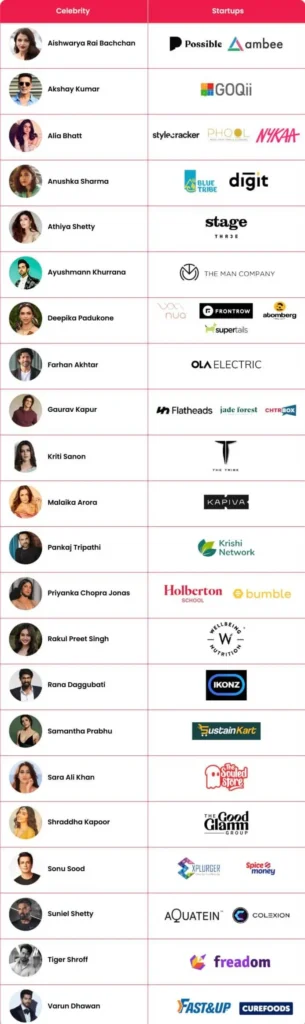

Popular Indian Celebrities and Their Startup Investments

| Celebrity Name | Profession | Startup / Brand Invested In | Sector | Nature of Involvement |

|---|---|---|---|---|

| Deepika Padukone | Actor | Epigamia, BluSmart | Wellness, EV Mobility | Equity investor, brand alignment |

| Alia Bhatt | Actor | Nykaa, Phool.co | Beauty, Sustainable Products | Strategic investor |

| Virat Kohli | Cricketer | One8, Rage Coffee, Digit Insurance | FMCG, Fintech | Investor and brand partner |

| MS Dhoni | Cricketer | Khatabook, Garuda Aerospace | Fintech, Drone Tech | Equity investor, advisor |

| Suniel Shetty | Actor | Curefoods, S2 Realty | FoodTech, Real Estate | Mentor and early-stage investor |

| Ranveer Singh | Actor | Sugar Cosmetics | Beauty (D2C) | Strategic equity partner |

| Akshay Kumar | Actor | GOQii | HealthTech & Fitness | Investor and brand promoter |

| Shraddha Kapoor | Actor | MyGlamm | Beauty & Personal Care | Co-owner and brand face |

These investments reveal a clear pattern: Indian celebrities are no longer simply chasing quick endorsement money. Instead, they are choosing startups with a long-term vision and scalable models, positioning themselves not just as the face of the brand but as partners in its growth.

The Risks and Challenges Behind Celebrity Startup Investments

Many celebrity-backed startups have also failed. Many early-stage businesses struggle with scaling, cash flow problems, or market competition, and star power alone cannot compensate for weak business fundamentals.

Overvaluation is another common risk. The hype generated by a celebrity association can inflate a startup’s valuation, making it difficult to justify future funding rounds if performance doesn’t meet expectations.

Lack of engagement can also be a challenge. Some celebrities invest passively, and without active guidance or strategic input, the startup may not fully benefit from the partnership.

Finally, reputational risk works both ways. If a startup faces legal, ethical, or operational issues, the celebrity’s public image can also be affected, making such investments a calculated risk rather than a guaranteed win.

What the Future Looks Like for Celebrity Investing in India

In the coming years, celebrity investing in India will likely become more structured and strategic. Instead of making ad hoc investments, many celebrities may form formal angel networks, partner with venture capital firms, or launch their own investment arms to professionally manage their portfolios.

As startups mature and governance improves, celebrities will increasingly focus on businesses with strong fundamentals, clear revenue models, and long-term scalability. Purpose-driven startups in sustainability, health, and technology will attract more attention as investors seek both financial returns and meaningful impact.

Overall, celebrity involvement in the startup ecosystem is evolving towards a more disciplined approach. This strategy, which combines fame with financial acumen, has the potential to make celebrities long-term contributors to India’s entrepreneurial growth.

FAQs about Indian Celebrities Are Investing in Startups

Why are Indian celebrities investing in startups?

To build long-term wealth and diversify income beyond films and sports.

Do celebrities manage the startups they invest in?

No, most act as investors or advisors, not daily managers.

Which sectors attract celebrity investors the most?

Consumer brands, fitness, fintech, wellness, and tech platforms.

Does celebrity investment guarantee startup success?

No, strong business fundamentals still matter more than fame.

Is celebrity startup investing increasing in India?

Yes, it is growing as startups become more mature and structured.

Conclusion

Indian celebrities’ investments in startups reflect ambition and awareness, demonstrating that success is no longer limited to fame alone. As these stars choose purpose-driven businesses and long-term partnerships, they are quietly shaping a future where influence creates value—for themselves, for the startups they invest in, and for India’s burgeoning entrepreneurial spirit.

Follow TheReviewNow for more updates

Fresh OTT news, trailers, reviews & trending stories—delivered first.

Post Comment